Financial Times Publishes Obituary for ESG

"ESG

is beyond redemption, a testimonial to the consequences of letting good

intentions overwhelm good sense and allowing the selling imperative to define

and drive mission. May it RIP." October 22, 2023, Financial Times.

Actually Financial Times is a little late to the game of declaring

ESG, including the investment part, dead. Already we are in, as I detail

in O'Dwyer's Public Relations, the Post-ESG era.

Those determined to tame capitalism, as had the noisy advocates of ESG

initiatives, have to come up with very different models.

Meanwhile, as we bore witness, hedge fund Engine #1, which

put three ecos on the Exxon board, didn't balk at the corporation's recent

mega acquisition of Pioneer.

Legal experts speculate that the Department of Justice,

along with several states, will lose the antitrust case against Google

("US, et al. v Google"). Here is a copy of the complaint. That win could discourage

the filing other such antitrust lawsuits and will enhance the brand of the law

firm defending it. That's Paul Weiss.

A confluence of forces is making liberal institutions of

higher learning such as Harvard seemingly subject to Wall Street.

Oh, capitalism is back - and stronger.

If human beings are capable of learning the lesson here

related to the former wild embrace of ESG (as well as blockchain and the

metaverse) is to give time time. Allow a promising or even seductive concept to

prove itself out over the long term. In my coaching, the majority of clients

are skeptical of the rush of initiatives pumped into the workplace as

uncertainty escalates.

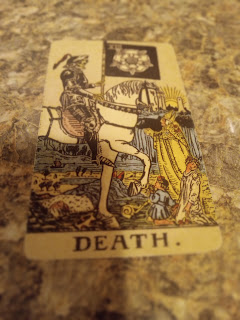

Data or the gut for your careers and communications? Both

of course. Complimentary consultation with intuitive coach, content-creator,

and Tarot reader Jane Genova (text 203-468-8579, janegenova374@gmail.com).

Comments

Post a Comment